Waves - Other Indicators

The Waves indicator includes several additional indicators that enhance analysis by offering insights into broader trends, money flow, and overbought/oversold conditions. These indicators provide essential context to help confirm signals and improve decision-making.

Overview of Additional Indicators

This page covers the following complementary indicators:

- Extra Moving Average (MA)

- Background Color Coding for Overbought/Oversold Regions

- MoneyFlow Indicator

- Multi-Timeframe Data Table

- Overbought and Oversold Levels (OBL and OSL)

Each section provides a description, visual example, and guidance for practical use.

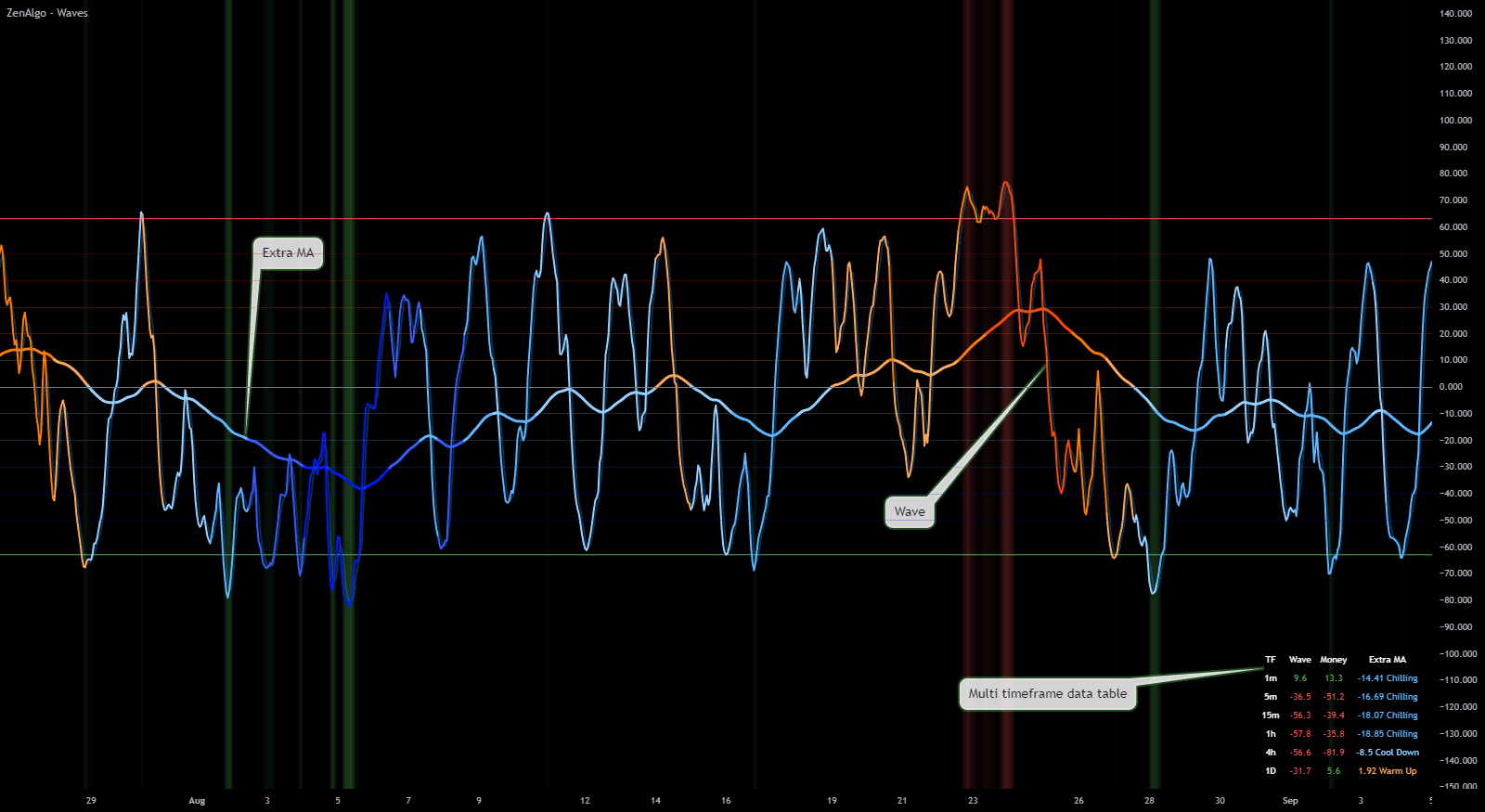

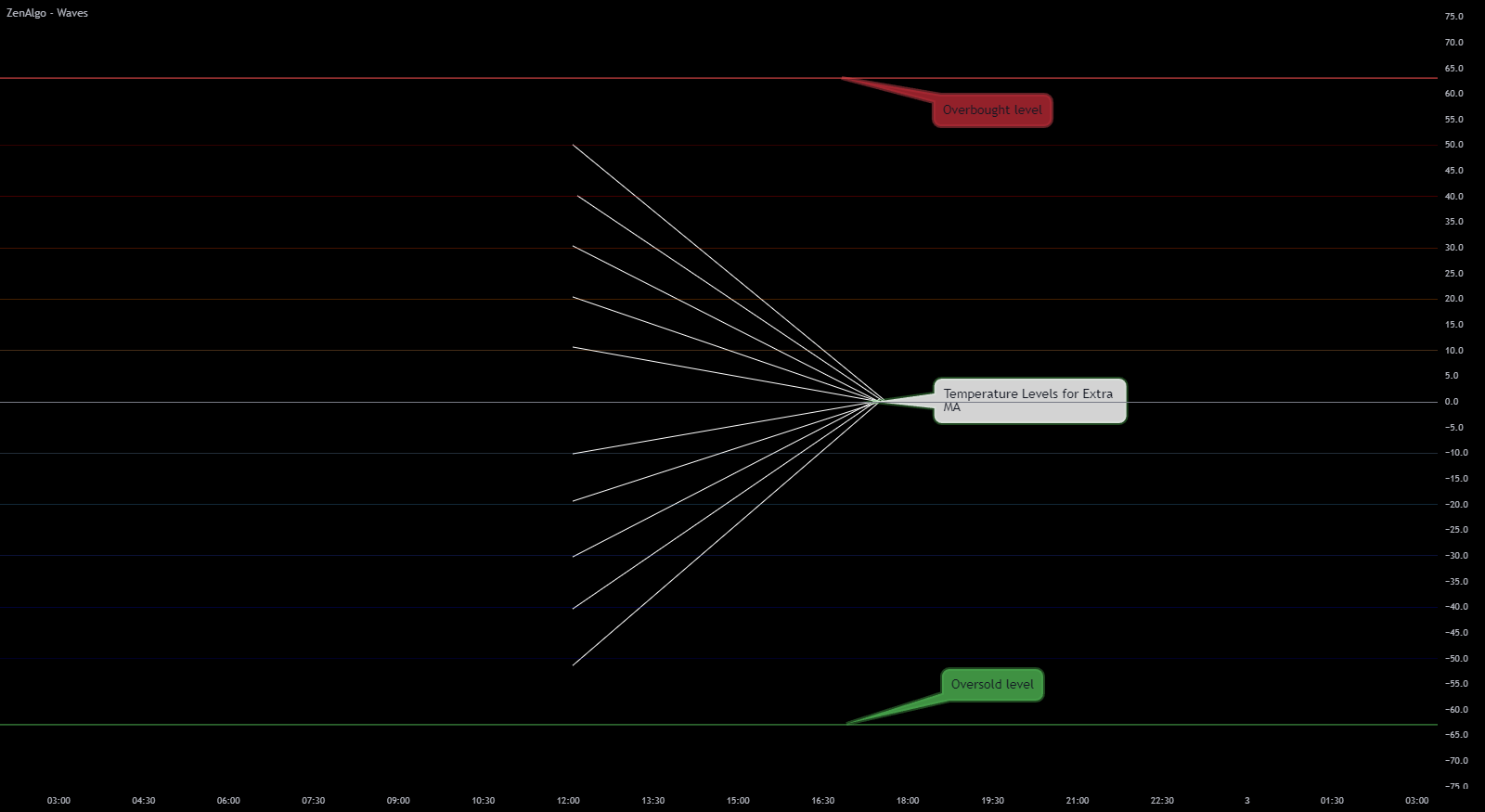

1. Extra Moving Average (MA)

The Extra Moving Average (MA) is an additional trend line integrated into the Waves structure to help assess the broader trend. The MA's state is color-coded in the multi-timeframe table, providing a quick visual reference for trend direction across different timeframes.

How to Use the Extra Moving Average

- Identify Overall Trend: The color-coded MA helps you quickly see if the trend is bullish or bearish across multiple timeframes.

- Confirm Signal Strength: Use the extra MA to confirm if the trend aligns with Wave and Signal crossovers for added confidence.

- Monitor Trend Changes Across Timeframes: The multi-timeframe table lets you view how the trend varies across different timeframes, helping you align your trades with the dominant trend.

The Extra MA is especially helpful in identifying trend reversals. For example, a sudden color change in higher timeframes may signal a shift in the overall market direction.

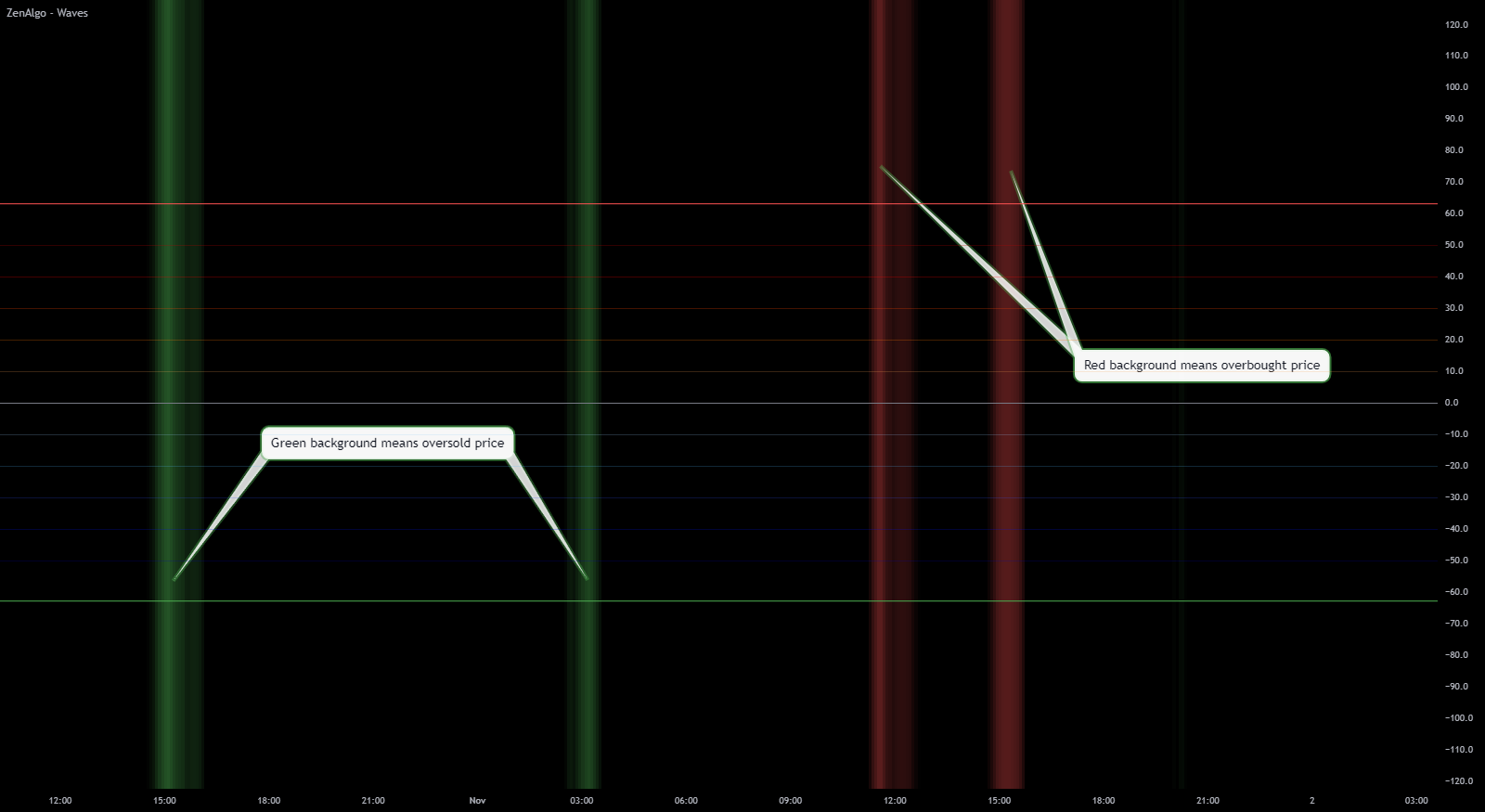

2. Background Color Coding for Overbought/Oversold Regions

The Waves indicator uses green and red background colors to highlight overbought and oversold zones dynamically based on Wave intensity relative to OBL (Overbought Level) and OSL (Oversold Level). This visual tool helps you easily spot extreme market conditions and aids in making entry or exit decisions.

How to Use Background Color Coding

- Identify Reversal Zones: Green backgrounds indicate oversold conditions, suggesting buying opportunities, while red backgrounds indicate overbought conditions, signaling potential selling points.

- Avoid Overextended Markets: Use background colors to avoid entering trades in overbought (red) or oversold (green) conditions, which may be due for a reversal.

- Combine with Other Indicators: Pair background color signals with Wave and Signal crossovers to improve accuracy.

Background colors can be a quick reference during volatile periods. For example, a green background with a bullish Wave crossover adds extra confidence for a buy decision.

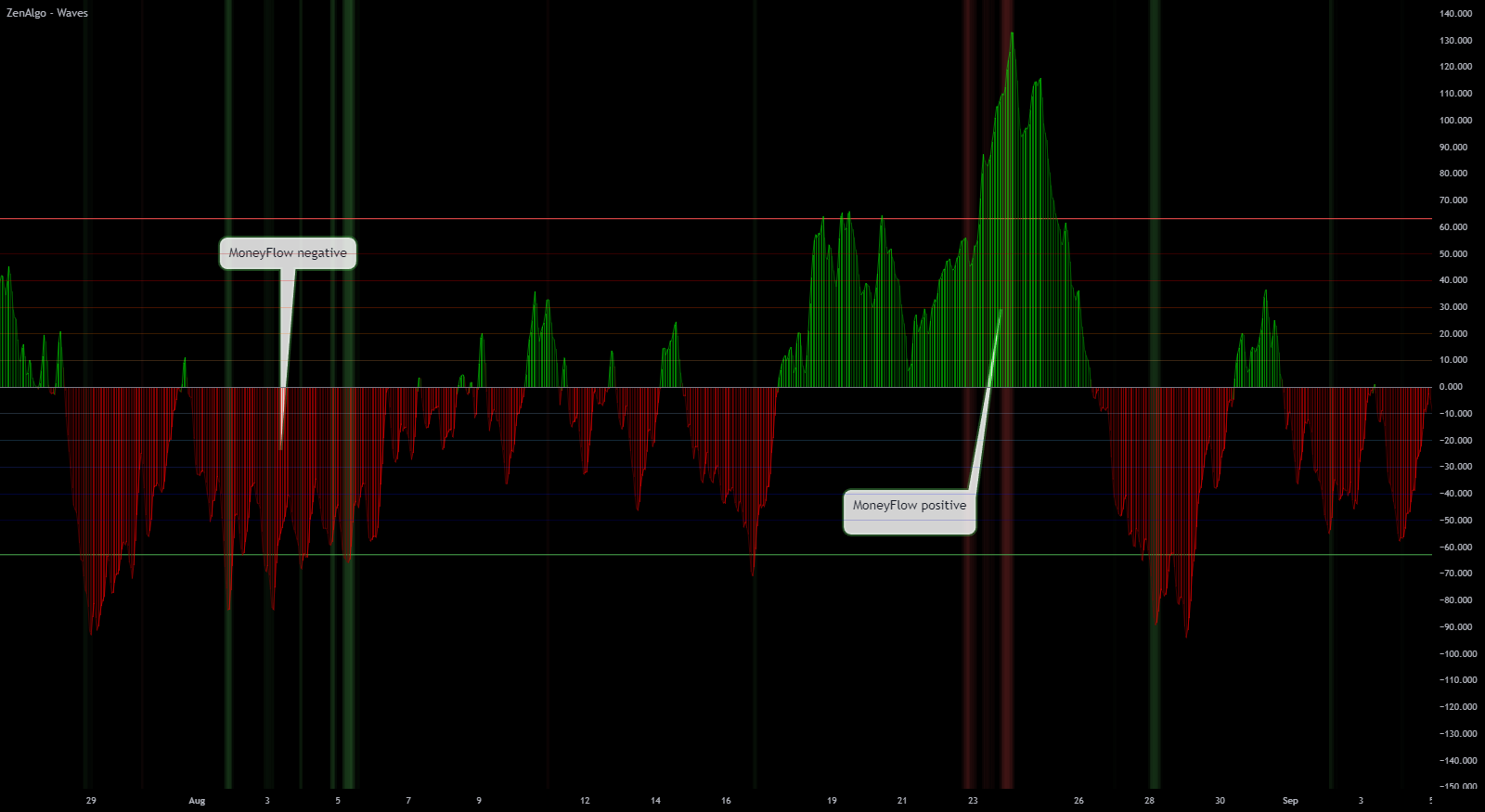

3. MoneyFlow Indicator

The MoneyFlow Indicator tracks the inflow and outflow of money, showing the strength behind price moves. Rising MoneyFlow indicates buying interest, while falling MoneyFlow signals selling pressure. When combined with Wave and Signal, MoneyFlow provides added confirmation for trade entries and exits.

How to Use MoneyFlow

- Confirm Trend Strength: If both MoneyFlow and Wave are aligned in the same direction (up or down), it strengthens the signal.

- Identify Divergences: Look for divergences between price and MoneyFlow to spot potential reversals.

- Gauge Buying/Selling Pressure: Rising MoneyFlow during a bullish Wave crossover indicates strong buying pressure, while falling MoneyFlow during a bearish crossover suggests selling pressure.

MoneyFlow divergences are useful for early trend reversal signals. For example, if price is rising but MoneyFlow is falling, it may indicate that the uptrend is weakening.

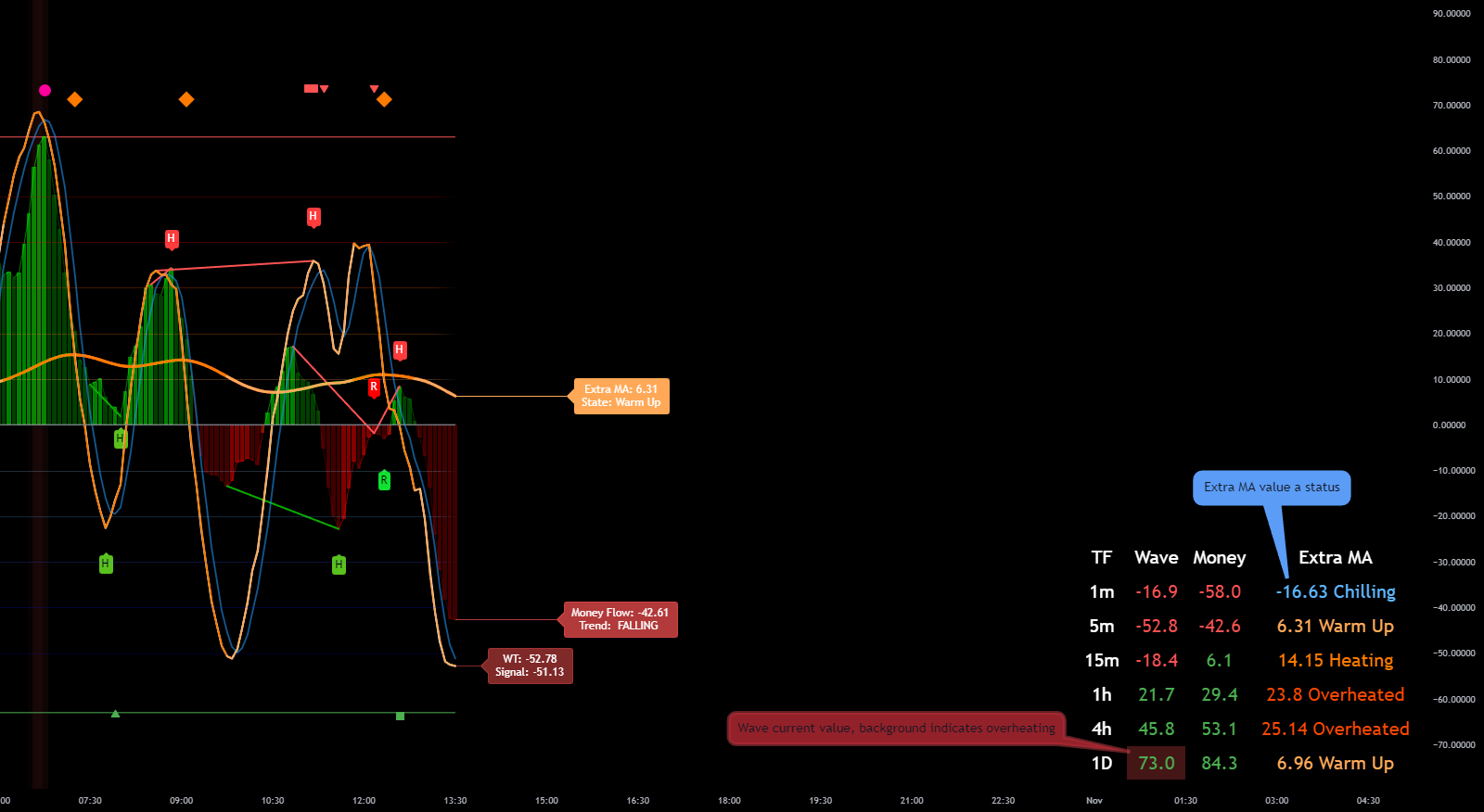

4. Multi-Timeframe Data Table

The Multi-Timeframe Data Table displays values across different timeframes for indicators such as Wave, WT, MoneyFlow, and Extra MA. You can customize the table's size, position, and text to match your preferences, providing a quick reference to trend direction across multiple timeframes.

How to Use the Multi-Timeframe Data Table

- Monitor Multi-Timeframe Trends: Check the table to view the alignment of indicators across timeframes. For instance, bullish alignment across several timeframes adds confidence to a buy decision.

- Customize Display: Adjust the table's size and positioning for quick access and to avoid clutter on your chart.

- Use for Trend Confirmation: When indicators align in the same direction across multiple timeframes, it signals stronger trend continuity.

Use the Multi-Timeframe Data Table as your "dashboard" for trend confirmation across timeframes, especially if you're trading with a longer outlook.

5. Overbought and Oversold Levels (OBL and OSL)

The Overbought Level (OBL) and Oversold Level (OSL) are plotted on the chart to help identify potential reversal zones. When the price reaches OBL or OSL, it's often at a point where the trend may be about to change.

How to Use OBL and OSL Levels

- Spot Reversal Points: The OBL and OSL levels act as warning zones where price reversals are more likely.

- Avoid Buying at Overbought Levels: Reaching OBL often signals that price is overextended, suggesting caution for buyers.

- Look for Buying Opportunities at OSL: OSL indicates potential undervaluation, making it a good zone for considering buy entries.

For stronger trade setups, wait for the Wave to confirm with a bullish crossover at OSL (or a bearish crossover at OBL) to increase the probability of success.

Summary of Other Indicators

- Extra Moving Average (MA): Assesses the broader trend and is color-coded across timeframes.

- Background Color Coding: Highlights overbought/oversold regions for easy identification of extreme conditions.

- MoneyFlow Indicator: Tracks money inflow and outflow, helping confirm price strength.

- Multi-Timeframe Data Table: Provides trend insights across multiple timeframes.

- Overbought/Oversold Levels (OBL and OSL): Identifies potential reversal zones.

These additional indicators offer valuable context and enhance the functionality of the Waves indicator, making it a comprehensive tool for informed trading decisions.