Waves - Symbols

If you're using ZenAlgo - Waves, your chart might look busy with various symbols and labels. Don't worry—here's a breakdown of each symbol and label so you can understand exactly what you're seeing.

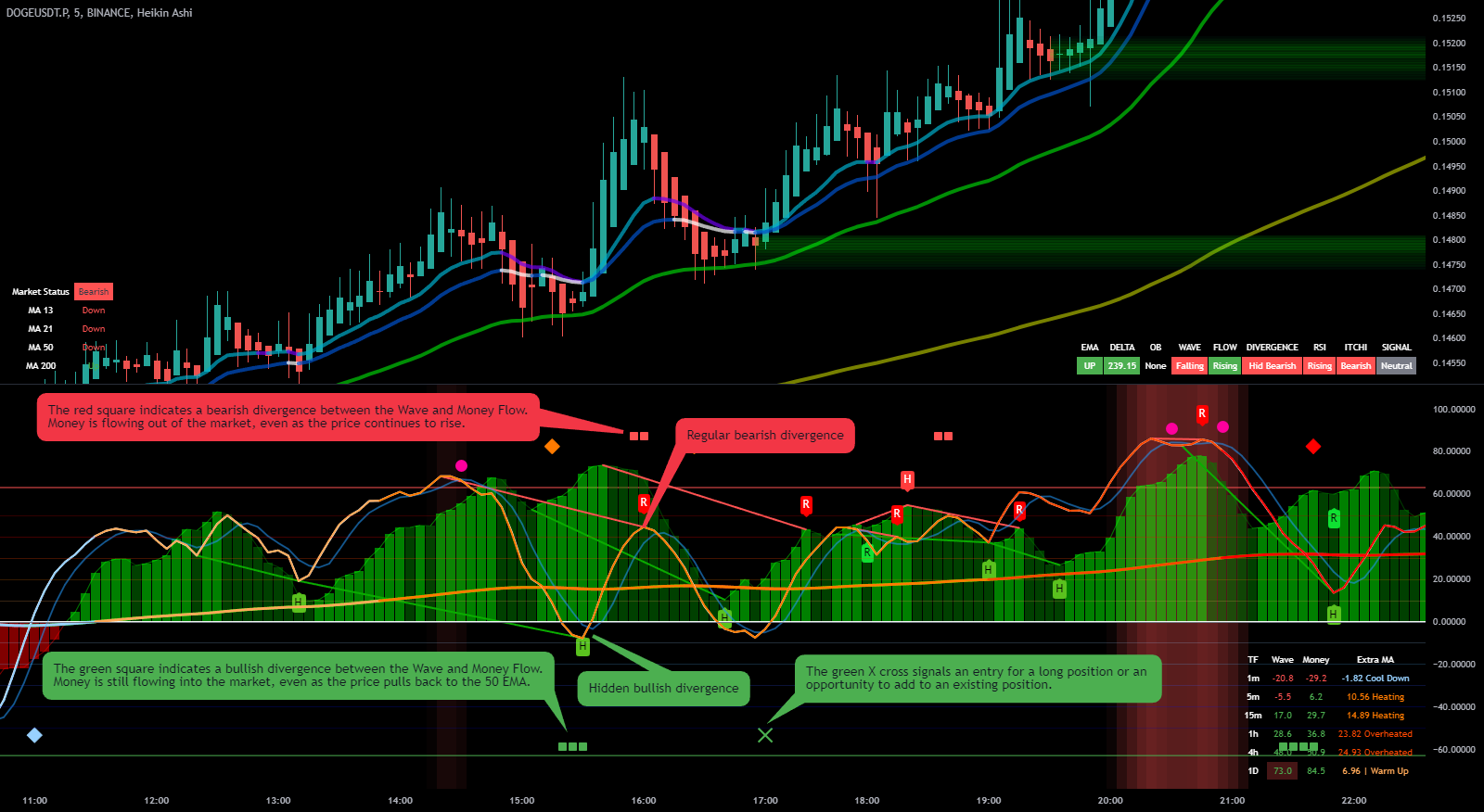

Green and Red Bars: MoneyFlow Histogram

- MoneyFlow Histogram: The green bars show increasing MoneyFlow, indicating positive momentum, while red bars show decreasing MoneyFlow, highlighting negative momentum. This histogram provides a quick view of where the money is flowing.

Use the MoneyFlow Histogram to confirm bullish or bearish momentum at a glance—green suggests buyers are active, while red indicates selling pressure.

Light Blue and Orange Lines: Wave and WT2

- Wave (WT1): The light blue line represents the core trend oscillator, measuring market momentum and trend direction.

- WT2: The orange line is a smoothed moving average of Wave, helping to clarify trend signals. Crossovers between Wave (WT1) and WT2 are key indicators for potential buy or sell points.

Watch for Wave and WT2 crossovers—when Wave crosses above WT2, it may signal a buying opportunity, and when it crosses below, a sell signal.

Red and Green "R" and "H" Labels: Divergence Markers

- R (Regular Divergence): When price moves in one direction while Wave diverges, this signals a potential reversal. The "R" label marks these discrepancies.

- H (Hidden Divergence): The "H" label indicates a hidden divergence, often signaling a continuation of the current trend. These signals are subtle but can be powerful.

Look out for regular divergence as an early sign of trend reversal, especially in conjunction with other signals like MoneyFlow or WT2.

Colored Diamonds: Continuation Signals

- Blue Diamond: Indicates a continuation of a bullish trend, suggesting that bullish momentum is holding strong.

- Orange Diamond: Signals a continuation of a bearish trend, suggesting caution against taking countertrend positions.

Consider blue diamonds as a "thumbs-up" for ongoing bullish conditions, and orange diamonds as a warning to maintain bearish positions.

Red "X" and Triangles: Sell Signals

- Red X: A strong sell signal triggered when WT1 crosses below WT2, with MoneyFlow in a confirming opposite condition.

- Red Triangle: A weaker sell signal, appearing when WT1 crosses below WT2 but lacks full confirmation from other indicators.

Use the Red X as a high-confidence sell signal and the Red Triangle with caution, as it indicates weaker sell conditions.

Red and Green Squares: Divergence Squares

- Red Square: Indicates decreasing MoneyFlow while Wave is rising, signaling weakening upward momentum.

- Green Square: Shows increasing MoneyFlow while Wave falls, suggesting a potential bullish reversal.

Use red squares as a heads-up for possible declines and green squares as early signals of a bullish reversal.

Right-Side Data Table

- TF (Timeframe): Shows key metrics for different timeframes (e.g., 1m, 5m, 15m).

- Wave and Money: Displays the current Wave (WT1) and MoneyFlow values across timeframes, offering a complete view of market trends.

- Extra MA: Indicates the state of Extra Moving Average in various timeframes, using terms like "Chilling" or "Heating" for quick interpretation.

When multiple timeframes show alignment in Wave or MoneyFlow, it strengthens the signal, giving you added confidence in your trade.

Bubbles with Text: On-Chart Labels

- Red Bubble (WT and Signal): Shows current values for Wave (WT1) and WT2 at a specific candle, providing quick reference for crossovers.

- Blue and Red Bubbles (MoneyFlow and Extra MA): Indicate current status of MoneyFlow and Extra MA, with descriptive states like "Chilling" or "Heating" for quick context.

Use these bubbles to quickly check if you're approaching a crossover or a critical MoneyFlow condition, without taking your eyes off the chart.

Quick Tips for Reading the Chart

- Green means "Go": Generally, green symbols indicate positive signals, whether it's a square, bar, or divergence marker.

- Red means "Caution": Red symbols suggest caution, signaling a potential reversal or need for reassessment.

- Crossovers are Key: Pay special attention to Wave and WT2 crossovers—they're significant for entry and exit points.

Conclusion

It might seem like a lot to digest initially, but with some practice, these symbols and labels will become intuitive. Use this guide to familiarize yourself with each component, and soon, ZenAlgo - Waves will become an essential part of your trading toolkit.

Happy trading, and may the waves always be in your favor!