Waves - Signals

The Waves indicator provides various signals to help traders identify optimal entry and exit points. These signals include bullish and bearish markers, crossover indicators, overbought/oversold alerts, and contra signals. This page breaks down each type of signal with visuals and guidance for interpreting them in your trading.

Types of Signals in the Waves Indicator

- Bearish Signals

- Bullish Signals

- Crossover Signals (Diamonds)

- Overbought/Oversold Signals

- Contra Signals

- Strong Contra Signals (X Markers)

Each type of signal is explained in detail below to help you maximize the effectiveness of the Waves indicator in your trading strategy.

1. Bearish Signals

Bearish signals alert traders to potential selling opportunities, usually indicating that price momentum is turning downward. These signals are visually represented by downward triangles or red labels and often occur when conditions like a Wave crossing below the Signal line or MoneyFlow bearish divergence are detected.

How to Use Bearish Signals

- Exit Long Positions: Bearish signals can indicate a potential downtrend, making it a good time to close long positions.

- Enter Short Positions: These signals suggest possible short-selling opportunities.

- Look for Confirmation: Confirm bearish signals with other indicators or trend analysis to strengthen your decision.

Bearish signals are most effective when they align with key resistance levels, increasing the likelihood of a successful short trade.

2. Bullish Signals

Bullish signals highlight potential buying opportunities and suggest upward momentum in the price action. These signals include upward triangles, green labels, and other markers that appear when conditions like a Wave crossing above the Signal line or MoneyFlow bullish divergence are present.

How to Use Bullish Signals

- Enter Long Positions: Bullish signals are generally considered good entry points for long positions.

- Monitor for Reversals: Bullish signals appearing after a downtrend may indicate the start of a reversal.

- Confirm with Additional Indicators: Use support levels, trend analysis, or other momentum indicators to confirm bullish signals.

Combine bullish signals with oversold levels to increase the probability of a successful trade entry, as these often represent discounted price levels.

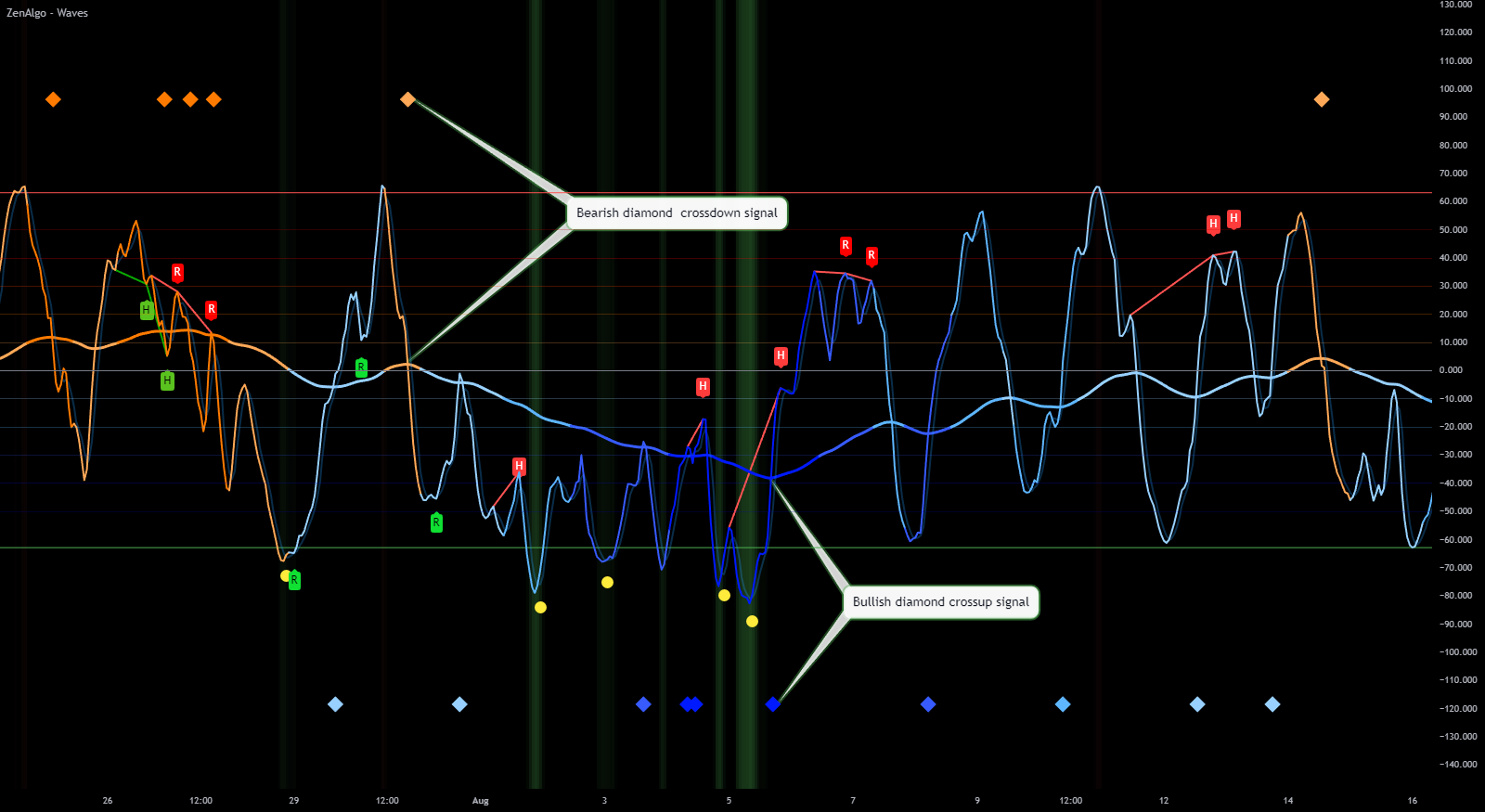

3. Crossover Signals (Diamonds)

Diamond markers are used to indicate crossover events between the Wave line and an additional Moving Average (MA). These crossovers are essential for identifying trend shifts, with color-coded diamonds for bullish (uptrend) and bearish (downtrend) crosses.

How to Use Crossover Signals

- Enter on Crosses: A bullish diamond suggests a buy opportunity, while a bearish diamond signals a sell opportunity.

- Confirm with Market Conditions: Use crossover signals in conjunction with broader market trends for a stronger entry or exit point.

- Monitor Subsequent Movement: Watch the price action following a crossover for potential follow-through.

Crossover signals work well in trending markets but may produce mixed results in sideways markets. Use trend analysis to determine optimal conditions.

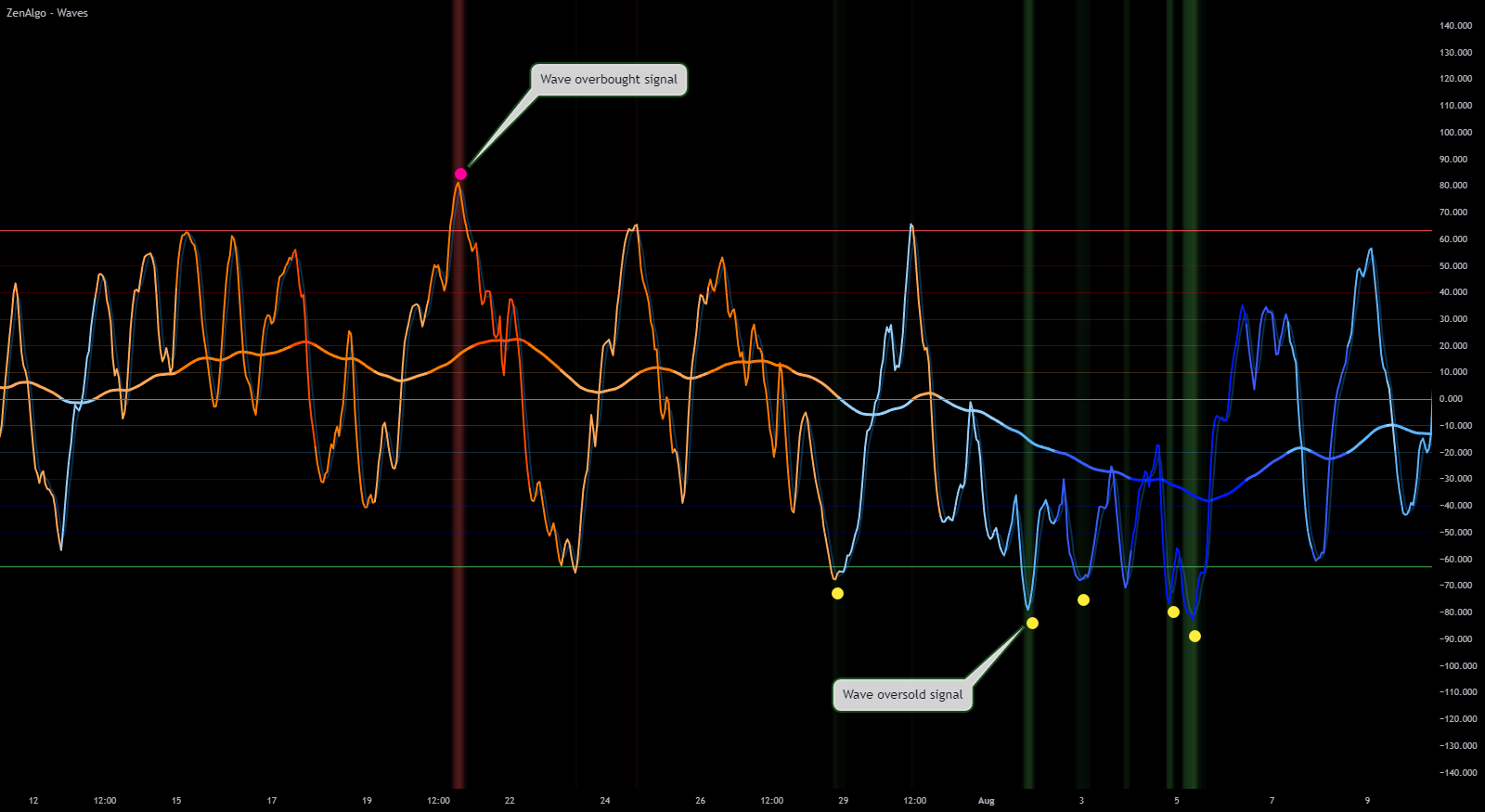

4. Overbought/Oversold Signals

Overbought and oversold signals provide insights into potential reversal zones by marking when the market may be reaching exhaustion points. Green markers represent oversold levels (buying opportunities), while red markers indicate overbought levels (potential selling points).

How to Use Overbought/Oversold Signals

- Identify Reversals: Look for price reversals when these signals appear, as they often mark exhaustion zones.

- Avoid Overextended Moves: Entering at overbought levels may expose trades to reversal risks.

- Use as Entry Points: Enter at oversold levels for a higher likelihood of a positive price move.

Combine overbought/oversold signals with trend indicators to avoid false entries in extended trends. These signals work best when price action aligns with existing support or resistance.

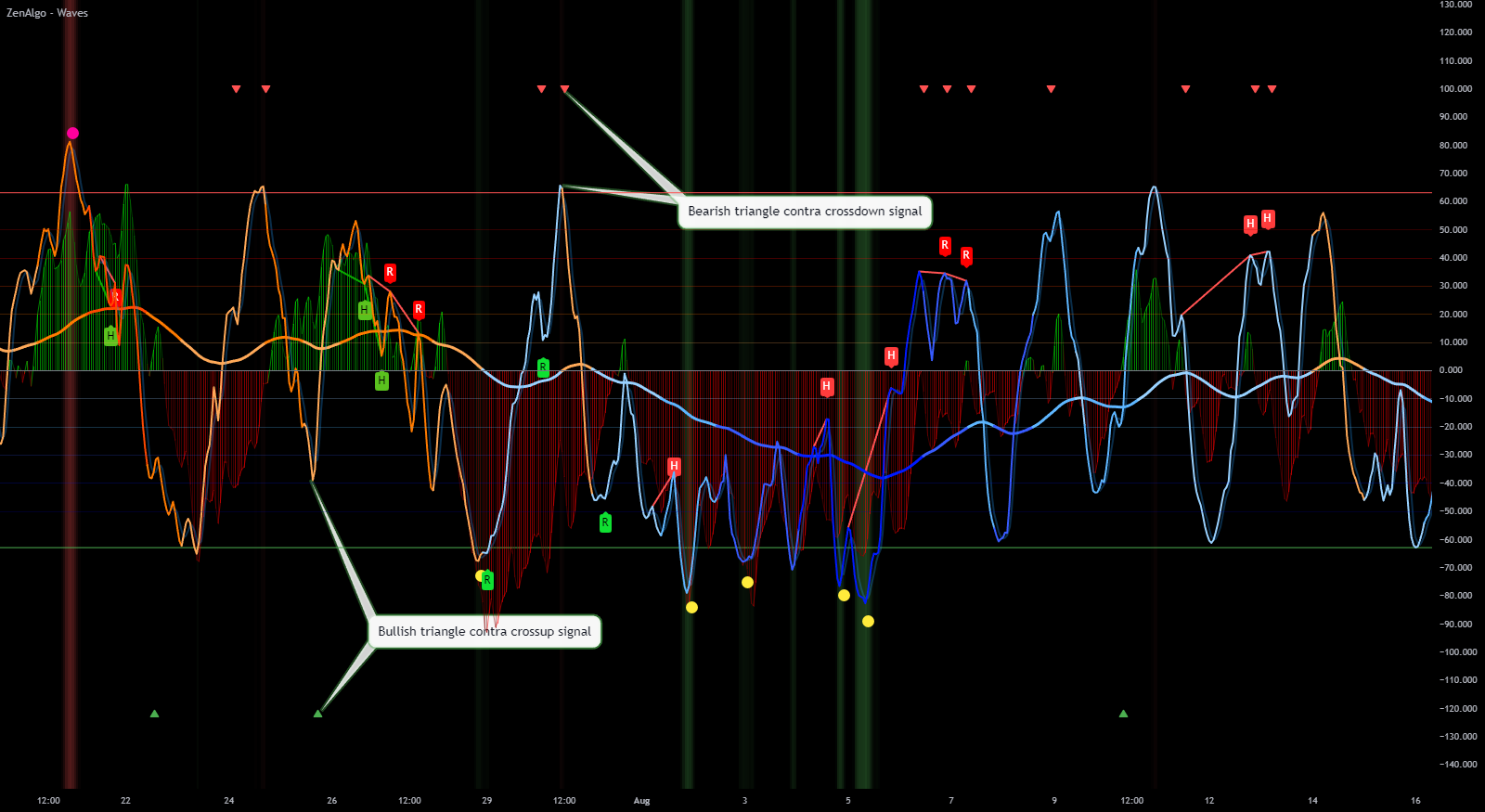

5. Contra Signals (Triangles)

Contra signals are moments when the Wave and Signal lines cross in a direction opposite to the prevailing trend. Green triangles indicate bullish contrarian signals, while red triangles signify bearish contrarian signals.

How to Use Contra Signals

- Spot Potential Reversals: Contra signals are effective in spotting potential reversals when the trend is reaching an extreme.

- Countertrend Trades: Use these signals to enter trades in the opposite direction of the trend if market conditions support a reversal.

- Proceed with Caution: Contra signals indicate possible trend shifts but may require confirmation from other indicators.

Contra signals are riskier than standard signals since they go against the prevailing trend. Only use them when strong confirmation is present.

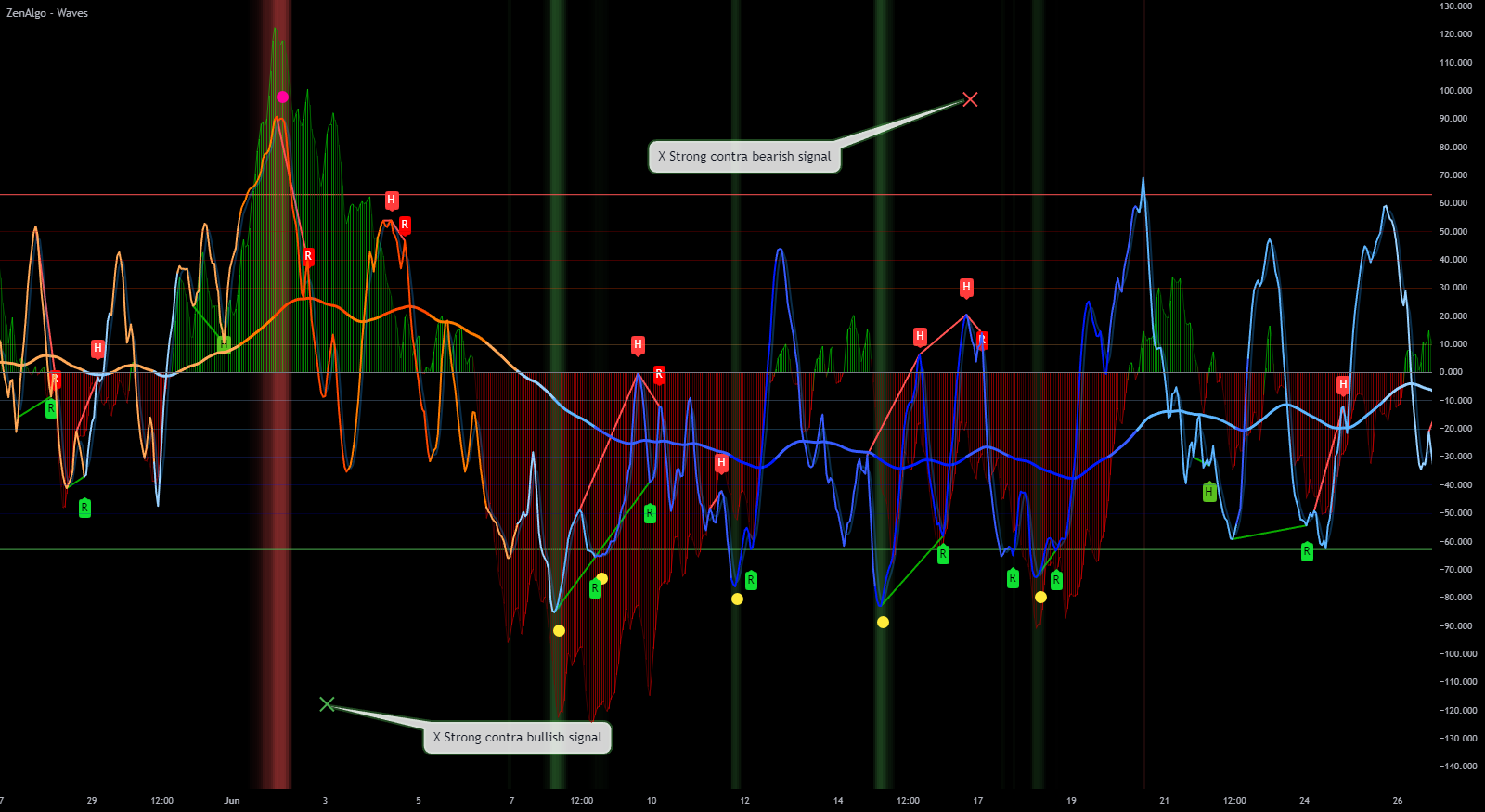

6. Strong Contra Signals (X Markers)

Strong Contra Signals are represented by X markers and are reserved for moments when multiple indicators align to signal a powerful reversal potential. Green "X" markers indicate a strong buy, while red "X" markers suggest a strong sell.

How to Use Strong Contra Signals

- Confirm Strong Reversals: Use X markers to validate high-confidence reversal trades.

- Wait for Alignment: These signals are strongest when combined with other indicators or levels, like support/resistance.

- Follow Through with Caution: While powerful, these signals should still be confirmed with market context.

Strong contra signals are ideal for high-conviction trades. Pair them with support/resistance or divergence indicators for the best results.

Summary of Signal Types

- Bearish Signals: Use to identify potential selling or shorting opportunities.

- Bullish Signals: Ideal for spotting buying opportunities.

- Crossover Signals (Diamonds): Help identify trend shifts via Wave and MA crossovers.

- Overbought/Oversold Signals: Indicate market exhaustion zones, useful for reversal trades.

- Contra Signals (Triangles): Spot contrarian opportunities against the prevailing trend.

- Strong Contra Signals (X Markers): High-confidence reversals when multiple indicators align.

Each of these signals adds unique insights, helping you make data-driven trading decisions based on momentum shifts and trend confirmations.