Heavy Delta - VWAP Indicator

The Volume-Weighted Average Price (VWAP) is a technical indicator that provides a price level weighted by the volume traded at different price points. Unlike a simple average price line, VWAP takes into account the amount of trading activity at each price level, making it more "volume-aware." 📊 Traders often use VWAP as a benchmark for identifying the "average" trader's position for the current session.

How It Works in the Code

Calculating the VWAP

The script requests price and volume data, feeding it into a built-in VWAP calculation function. The calculation resets at a chosen anchor period, such as the start of the session, week, month, quarter, or year, depending on the selected input.

For example:

- Use Session VWAP for intraday trading.

- Opt for Monthly VWAP for longer-term analysis.

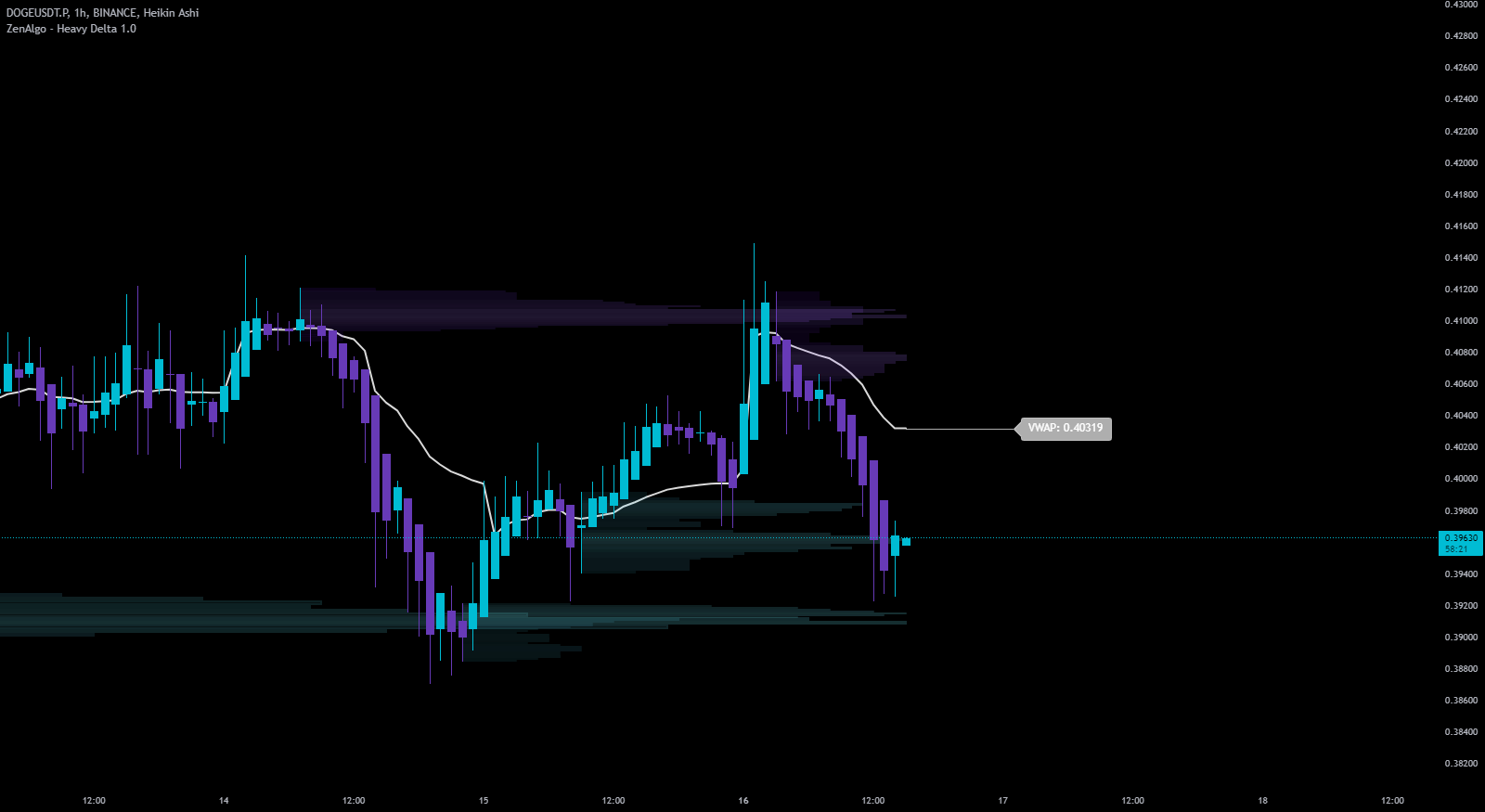

Plotting the VWAP Line

Once calculated, the VWAP line is drawn dynamically on the chart as new price and volume data become available. The code includes options to toggle the VWAP line and its label, which shows the current VWAP value on the right side of the chart. This ensures flexibility and clarity for traders.

Why is it Useful?

Market Benchmark

VWAP serves as a fair-value benchmark, helping traders gauge market sentiment:

- 📈 Price above VWAP: Indicates a stronger, bullish session.

- 📉 Price below VWAP: Suggests a weaker, bearish session.

🏦 Pro Insight: Institutional traders often compare their trade executions to VWAP to ensure they're getting a "better-than-average" price.

Support and Resistance

VWAP acts as a dynamic support or resistance level:

- Approaching VWAP from above: 🚀 Potential support zone.

- Approaching VWAP from below: ⚠️ Possible resistance.

Intraday Trading Tool

Intraday traders often rely on VWAP for precision:

- 💵 Buying below VWAP: Indicates a potential "discounted" entry.

- 💰 Selling above VWAP: Suggests a "premium" exit.

Customizations and Uses

Anchor Periods

⏳ Choose from various anchor periods (Session, Week, Month, Quarter, or Year) to match your trading strategy and timeframe.

Visibility and Labeling

📌 Toggle the VWAP line and its label for a clutter-free chart. The label shows the current VWAP value, making it easy to compare against the market price.

Combining with Other Indicators

VWAP becomes even more powerful when paired with other tools:

- Overlay moving averages to confirm trends.

- Use daily open levels to assess intraday sentiment.

- Combine with Monday ranges for weekly context.

If the price holds above both the daily open and VWAP, it reinforces a bullish intraday trend.

In Summary

VWAP is a powerful tool that blends price with volume, offering a more comprehensive view of the market's true trading level. 🧐 By using VWAP, traders can:

- Identify whether the current price is "fair" relative to the day's volume distribution.

- Detect overbought or oversold conditions more effectively.

Whether you're day trading or analyzing longer-term trends, VWAP provides a reliable and versatile benchmark for your strategies.