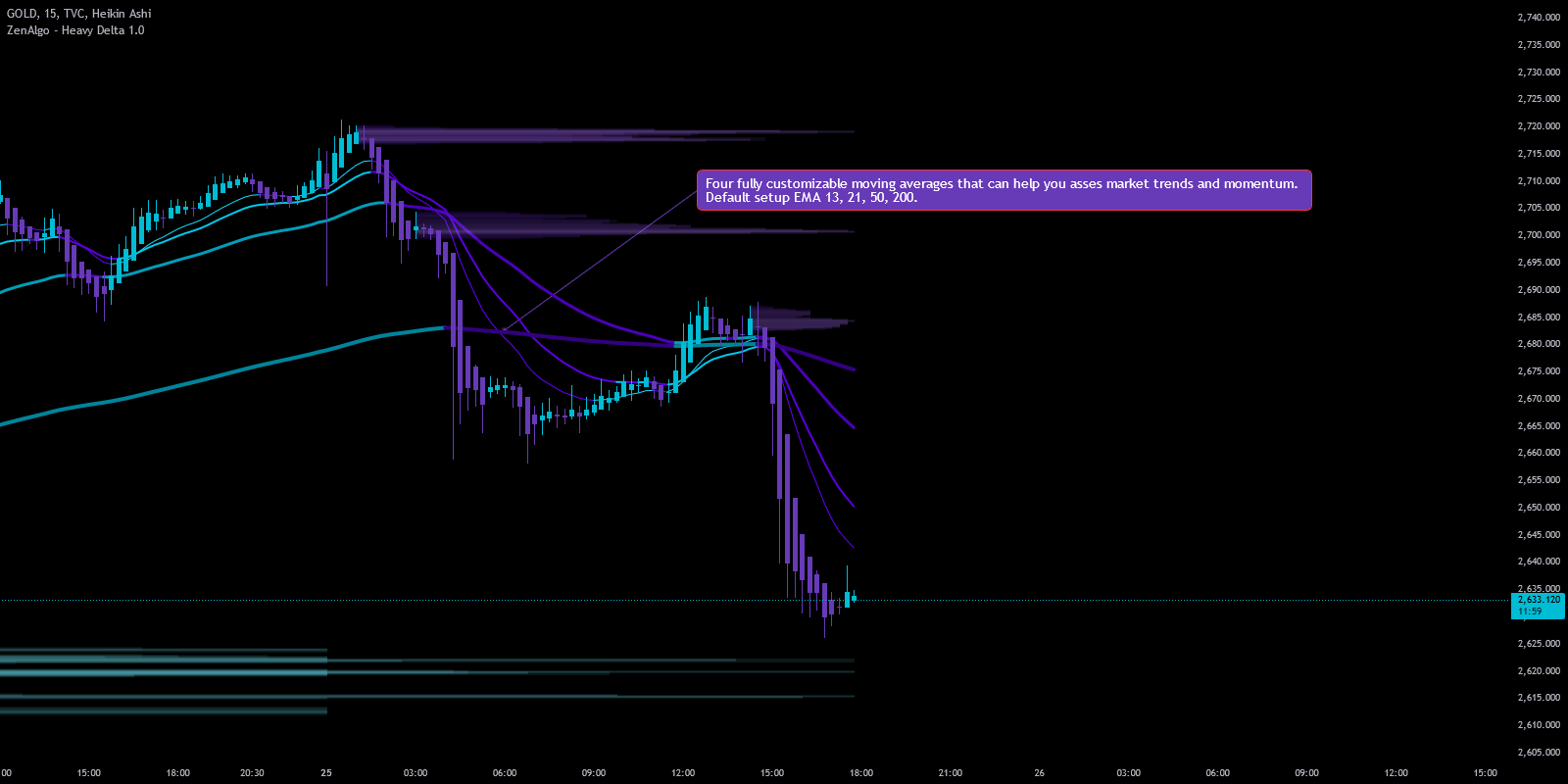

Heavy Delta - Moving Averages (MA)

ZenAlgo's Moving Averages (MA) feature includes four fully customizable MAs, allowing for a flexible assessment of market trends and momentum. MAs smooth out price data to reveal the market's underlying trend. By averaging price movements, MAs reduce noise, making market behaviors easier to visualize.

Moving averages are lagging indicators, reflecting past trends based on historical data rather than predicting future movements.

ZenAlgo Moving Averages Types

ZenAlgo offers various types of MAs suited for different strategies:

| Moving Average Type | Key Feature |

|---|---|

| EMA (Exponential MA) | Responsive to recent data |

| SMA (Simple MA) | General trend without fluctuation |

| WMA (Weighted MA) | Linear weighting on recent prices |

| HMA (Hull MA) | Reduced lag for quicker trends |

| VWMA (Volume Weighted MA) | Volume influences price weighting |

| RMA (Running MA) | Rolling average, similar to EMA |

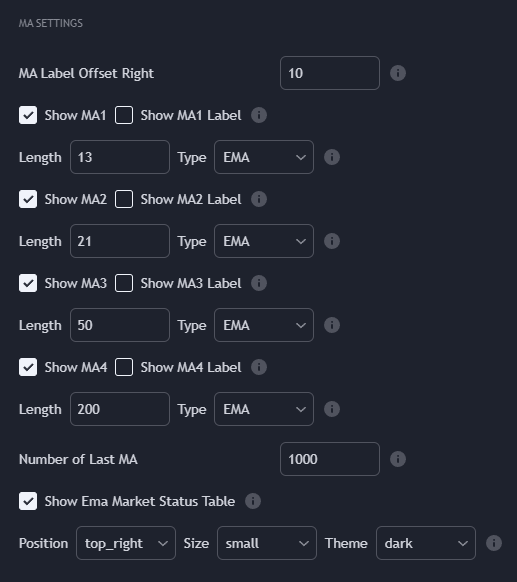

Each moving average type can be adjusted for length to suit specific timeframes (e.g., 13, 21, 50, 200). This flexibility means you can customize each MA for short- or long-term strategies. ZenAlgo indicators also offer dynamic color changes to help visualize trend direction:

- Bullish: Price above the MA with a designated color for upward momentum.

- Bearish: Price below the MA with a contrasting color for downward momentum.

Configuration

ZenAlgo's MAs are tailored to match diverse trading styles, providing valuable insights at a glance.

Market Status Table Overview

The Market Status Table in ZenAlgo is a powerful feature to instantly gauge market sentiment based on price interaction with various Moving Averages.

Market Status Levels

The Market Status Table in ZenAlgo offers a straightforward yet powerful way to quickly understand the overall market sentiment by showing how price interacts with multiple Moving Averages (MAs). This table not only displays whether price is above or below each MA but also summarizes the broader market trend in simple, easy-to-understand terms. Let's break it down:

- MA Comparison: The table includes key moving averages—typically

MA 13,MA 21,MA 50, andMA 200. It shows whether the price is currently positioned above or below each of these MAs, with clear labels such as "Up" or "Down". The color coding makes it intuitive: green signifies price above (bullish), while red indicates price below (bearish). - Market Status Levels:

| Market Status | Description |

|---|---|

| Neutral | When price is above two MAs, indicating potential without a strong trend. It may signal a reversal or awaiting momentum. |

| Bullish | When price is above three MAs, suggesting early buying pressure and a potential uptrend. |

| Full Bull | When price is above all four MAs, indicating a strong bullish trend across all timeframes. Long positions may be more favorable. |

| Bearish | If the price is below three MAs, showing downward momentum. |

| Full Bear | Price below all four MAs signals a strong downtrend, emphasizing bearish sentiment. |

This dynamic classification helps traders quickly interpret market health, making it easier to decide on cautious, aggressive, or neutral strategies. The Market Status Table simplifies tracking whether bulls or bears have the upper hand.