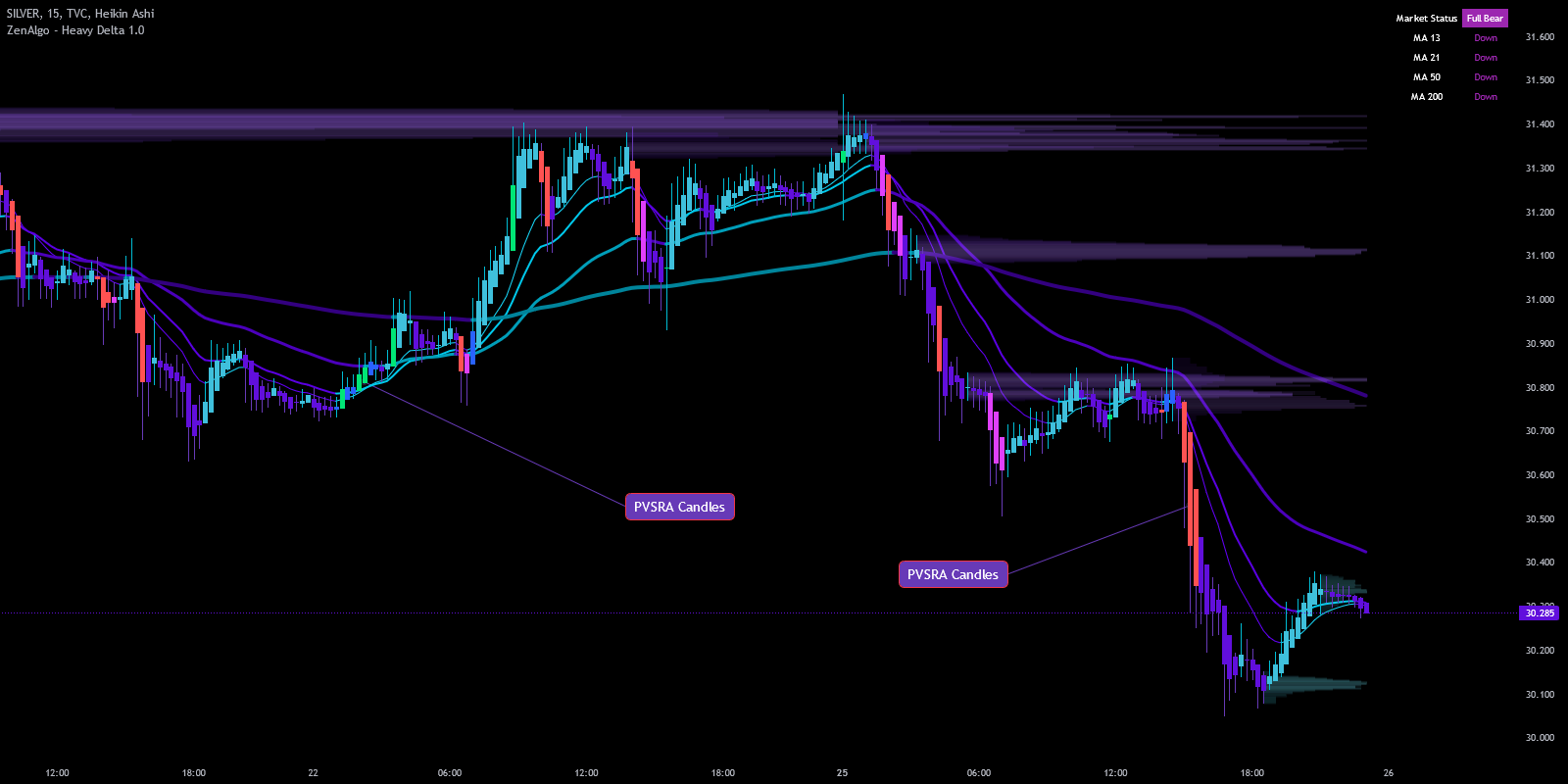

Heavy Delta - PVSRA Candles

ZenAlgo includes a unique feature called PVSRA Candlestick Coloring, which enhances the way you visualize market activity by integrating Price, Volume, and Support/Resistance Analysis (PVSRA). This system helps traders understand the actions of "smart money" by looking at the relationship between price movement, volume, and significant price levels.

PVSRA is a method designed to uncover the intentions of large institutional traders—often referred to as "market makers"—by closely examining price action and the volume behind it. The goal is to determine whether institutions are accumulating (buying quietly) or distributing (selling discreetly) in preparation for major market moves.

PVSRA offers insights into the behavior of "smart money" in the market. By analyzing price movements alongside volume and key levels, traders gain a window into institutional activity, potentially spotting market trends early.

Key elements of PVSRA

| Key Element | Description |

|---|---|

| Price | Analyzing how price behaves at critical levels, such as support or resistance, helps determine the possible direction of the next move. Sudden spikes or drops in price are often telling of institutional activity. |

| Volume | Volume is a crucial indicator for gauging the strength of a price move. PVSRA emphasizes volume as a key component, examining whether high volume occurs during a move up or down, which may indicate buying or selling pressure from institutions. |

| Support and Resistance | PVSRA takes into account important price levels where the market has historically had trouble moving past. The interaction between price and these levels, combined with volume analysis, helps identify accumulation or distribution areas. |

Visual representations

In ZenAlgo, the PVSRA Candlestick Coloring visually differentiates the sentiment behind each candle:

| Candle Type | Description |

|---|---|

| Bullish Candles | Often colored to indicate high buying interest, typically represented by higher volume on upward moves, suggesting strong institutional buying at certain price points. |

| Bearish Candles | Marked to highlight heavy selling pressure, often coupled with high volume, implying that institutions might be offloading positions. |

| Neutral or Key Levels | When price consolidates or approaches significant support/resistance with notable volume, the color coding helps indicate potential reversals or breakouts. |

This coloring system gives traders an immediate visual cue of the underlying market sentiment and the potential presence of institutional activity, allowing them to make more informed trading decisions.

When interpreting PVSRA candles, remember that color alone is not a guarantee of direction. Consider other indicators and analysis to confirm potential moves.

Configuration

Customize the PVSRA settings in ZenAlgo to align with your trading style. For example, adjust color settings to make high-volume bearish candles more prominent if you're focusing on spotting selling pressure.